“There is a tide in the affairs of men, which taken at the flood, leads on to fortune. Omitted, all the voyage of their life is bound in shallows and in miseries.” – William Shakespeare

Since 2013, Vancouver-headquartered Methanex (MEOH)(MX.TSX) – the world’s largest methanol producer – has been re-shoring its overseas plants back to North America, to take advantage of the abundant and cheap natural gas in the U.S. and Canada.

What is the implication of this strategic move to the natural gas producers where it is moving from, e.g., GeoPark (GPRK)? And to natural gas producers in North America such as Chesapeake (CHK) and Painted Pony Energy (OTCPK:PDPYF)(see here)? In this article, we analyze the ramifications of the large-scale reshoring of Methanex.

1. What is methanol and what about it?

Methanol, aka, methyl alcohol, is a chemical with the formula CH3OH or MeOH for short. It is sometimes called wood alcohol because it was once produced mainly as a by-product of the destructive distillation of wood.

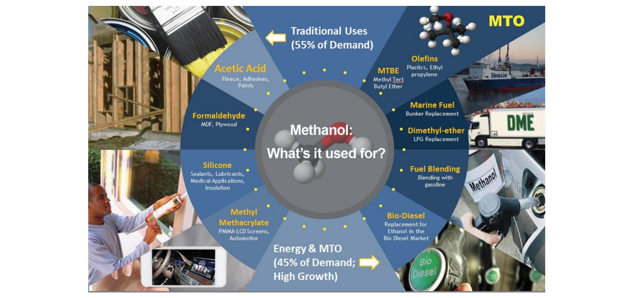

Methanol is used primarily as a feedstock by chemical plants for making acetic acid, formaldehyde, silicone, and methyl methacrylate, and as a fuel for bio-diesel, fuel blending, dimethyl-ether/marine fuel, and MTBE and olefins (Fig. 1).

Fig. 1. The uses of methanol, source: here.

Fig. 1. The uses of methanol, source: here.

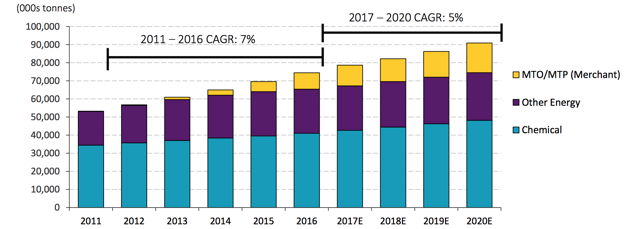

Global methanol demand has been growing at a steady pace and is projected to continue to expand at a CAGR of 5% between 2017 and 2020, led by MTO (Fig. 2).

Fig. 2. Strong demand growth of Methanol, source: Methanex presentation.

Fig. 2. Strong demand growth of Methanol, source: Methanex presentation.

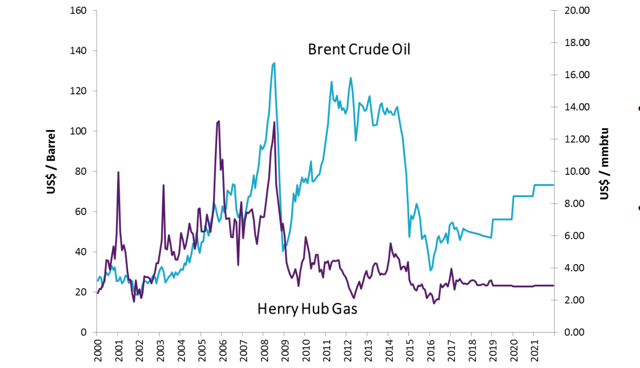

Methanol is chiefly made from natural gas and, since 2008, is a liquid fuel and oil product substitution. The gap between the prices of crude oil price and of natural gas creates an incentive to use methanol as the substitute of crude oil. Currently, the price ratio between crude oil and natural gas exceeds 15:1 MMbtu/bo, which is projected to widen in the near future (Fig. 3).

Fig. 3. A comparison of crude oil and natural gas prices, after Methanex presentation in September 2017.

Fig. 3. A comparison of crude oil and natural gas prices, after Methanex presentation in September 2017.

2. Methanex reshoring

2.1. Global supply chain

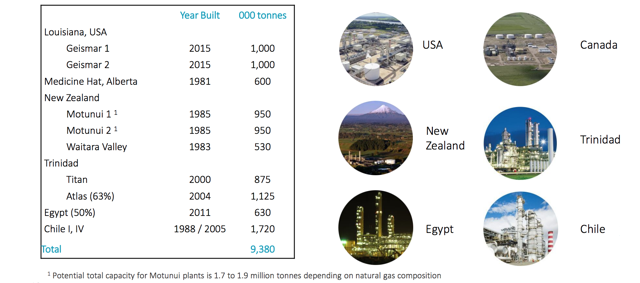

Methanex is the dominant producer of methanol in the world, capturing approximately 14% share of the 73 MMt/y global market as of 2Q2017 (see here). As the industry leader, the company has a global supply chain built with a capacity to respond to customers all over the world (Fig. 4).

Fig. 4. The global supply chain of Methanex, source: here.

Fig. 4. The global supply chain of Methanex, source: here.

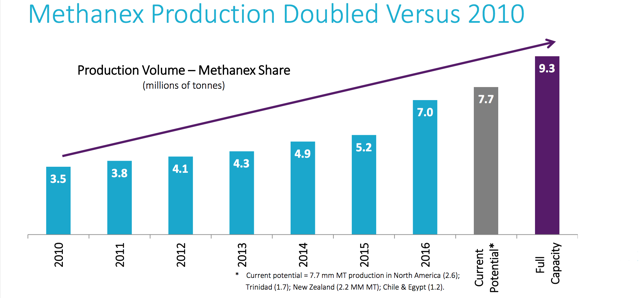

As of September 2017, the company has 11 production plants at six sites located at Louisiana, U.S.; Medicine Hat, Canada; New Zealand; Trinidad, Egypt; and Chile (Fig. 4; Fig. 5). Between these plants, the company has 9.38 MMt/y of nameplate capacity, with current potential at 7.7 MMt/y following years of consistent growth (Fig. 6).

Fig. 5. Methanex plants with annual production capacity, source: here.

Fig. 5. Methanex plants with annual production capacity, source: here.

Fig. 6. Methanex production, source: here.

Fig. 6. Methanex production, source: here.

2.2. Punta Arenas, Chile

There used to be four Methanex plants in Punta Arenas, Chile, which had imported natural gas from the neighboring Argentina, until that country more than doubled its export duty on gas. At one point, Methanex stopped receiving natural gas from all of its seven Argentine suppliers (see here), which used to contribute 62% its gas feedstock, with the rest supplied by ENAP.

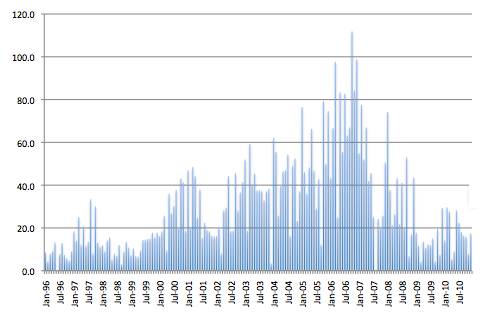

In response to the tax increase, Methanex in 2008 signed a natural gas exploration agreement with Chilean state company ENAP to seek an alternative source of gas. Chile offered 10 exploration blocks in the far south in June 2007; Methanex filled in the void left by Total (TOT), which for some reason did not show up to sign the contract that it had successfully bid (see here). But Chile experienced gas shortage as well, which forced Methanex to idle three of the four plants there and take a US$297 million write-down on those assets in 2012 (see here) (see note 1), which set the stage of the subsequent relocation of two idle plants to Louisiana. During this time, methanol production of Methanex dropped 75% (Fig. 7).

Fig. 7. Chile methanol exports per month in US$ million from 1996 to 2010, source: here.

On April 30, 2008, Methanex realized that it would not be able to bring all its plants in Chile back to operation within 3-4 years if it were to rely on Chilean gas sourced from the gas exploration project.

Even the Chile I plant could only operate on an on-and-off basis. The company restarted Chile I on September 18, 2014, using gas supplies from both Chile and Argentina through a tolling arrangement, after having been idled since May 2014 due to insufficient natural gas supply (see here). On September 17, 2015, Methanex signed a natural gas supply agreement with ENAP, on the back of the latter’s E&P success in the Arenal block. The agreement covered 14 MMcf/d of supply between 25 September 2015 and April 2016 (see here).

As of 3Q 2017, Methanex envisioned highly value-accretive opportunity to restore Chile to two-plant operation at 1.7 MMt/y at a low capital cost of US$55 million over the next 12 months. The Chile IV restart decision was made in 2Q2017, contingent on gas supply agreement. The company also plans to refurbish the Chile I plant for US$50 million once the Chile IV restart is complete, subject to securing additional economic gas sufficient for a two-plant operation.

2.3. Geismar 1 Relocation

On January 17, 2012, Methanex announced a plan to relocate one of its idle methanol plants in Punta Arenas, Chile, to Geismar, Louisiana. The relocation of the plant, as opposed to building from scratch, reportedly could save considerable capital expenses and shorten the project timeline.

According to Bruce Aitken, then-CEO of the company, the outlook for low North American natural gas prices, proximity to major consumers and world-class infrastructure made Louisiana an attractive location to produce methanol. He said (see here):

This project represents a unique opportunity in the industry to add capacity at a lower capital cost and in about half the time of a new greenfield methanol plant. The timing of this project is excellent: there is strong demand growth for methanol globally and there is little new production capacity being added to the industry over the next several years.

It costs US$425 million to relocate the plant move from Chile (see here). The company said it would recoup the relocation costs in four years. It signed a 10-year supply deal with Chesapeake in January 2013, which was a critical insurance against any potential unexpected spike in gas prices down the road (see here).

Geismar 1 started production in January 2015 (see here) and ran at 1 MMt/y full capacity within weeks of the start-up.

2.4. Geismar 2 Relocation

On April 24, 2013, Methanex decided to proceed with the relocation of a second 1 MMt/y methanol plant from Punta Arenas, Chile to Geismar, Louisiana, for an estimated total cost of US$550 million. John Floren, CEO of the company said (see here):

Relocating a second plant to Louisiana allows us to benefit quickly from the competitive natural gas price environment in North America and add additional molecules to our system to supply our customer’s growing requirements for methanol. The two Geismar projects, combined with our other growth initiatives in New Zealand and Medicine Hat, represent three million tonnes of additional operating capacity which we believe will create significant value for shareholders.

On March 27, 2014, Floren even indicated the company is considering building a new plant at Medicine Hat, Alberta, adding that it is also considering relocating the third Chile plant to Geismar. Of the five U.S. methanol plants that the company moved offshore in the mid-2000s when North America gas prices were high, three went to China. Now that the shale gas revolution has lower gas prices, those China plants “may come back to the U.S.” (see here).

Geismar 2 successfully produced first methanol on December 27, 2015, three months ahead of the original schedule. Floren commented (see here):

The total combined cost for the completion of the two Geismar plants is approximately $1.4 billion. We believe this represents a substantial cost savings relative to a new-build plant, and we expect the Geismar 2 plant will create significant cash-flow and value for shareholders.

3. Investor takeaways

3.1. Methanex

Methanex is currently enjoying the tailwinds of favorable demand growth on its back (Fig. 2), which is driven by the large gap between crude oil and natural gas prices (Fig. 3), a phenomenon likely to persist in the foreseeable future at least in North America considering the plenty of shale gas there. The company is the dominant players in its product space, having captured a 14% market share. It enjoys a global supply chain of scale; its distribution of multiple production sites at strategic locations accord an extra flexibility for the firm to respond to changing operating conditions, as exhibited in the relocation of the Punta Arenas, Chile, plants to Geismar, Louisana, which its smaller peers may not be able to do. Methanex is also increasing its production consistently (Fig. 6).

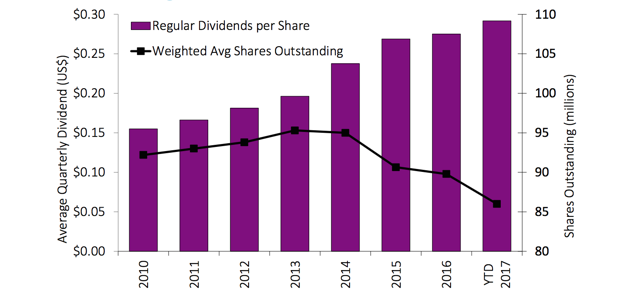

Fig. 8. The dividends per share and weighted average shares outstanding of Methanex, source: here.

Fig. 8. The dividends per share and weighted average shares outstanding of Methanex, source: here.

Methanex generated a free cash flow of US$150 million in 2016 (see here) and is expected to report a free cash flow of $800 million in 2017 (see here). Its operating margin is at 14.1%, net profit margin at 9.9%, and ROE at 17.3%. As of November 24, 2017, Methanex has a P/E of 16.6, PEG of 1.06, and an EV/EBITDA of 8.1 (see here). The company has been buying back shares since 2014; its dividend yield is at 2.20%, with a three-year dividend growth rate of 20.70% (Fig. 8).

As of November 24, 2017, it had a production capacity of 8.5 MMt/y but traded at an enterprise value of US$5.8 million, which implies the production capacity is being traded at US$682/ton on average. The replacement cost of the 2.6 MMt/y production capacity in North America is around US$1,100/ton, judging from data sourced from the OCI Natgasoline project and G2X Lake Charles project. That means all the remaining production capacity is being traded at US$413/ton, which is an incredible value. Therefore, Methanex appears to be a thriving business trading at a large discount.

3.2. GeoPark

GeoPark supplies natural gas to Methanex in Chile from its 100%-WI operated Fell Block (see here). From the above discussion, Methanex has a booming business and it explicitly stated that it intends to expand the Chilean operation if enough economical natural gas can be secured.

Therefore, GeoPark seems to have a reliable customer in Methanex if it can deliver low-cost natural gas, which can be achieved by controlling its F&D costs and opex in Chile.

3.3. North Amercian natural gas and Chesapeake

The reshoring of Methanex plants was just a harbinger of what was to happen for numerous other petrochemical plants (see here). The shale gas revolution led to abundant and cheap natural gas, which attracted petrochemical plants back to the U.S. by significantly lowering the natural gas feedstock prices.

In return, the revival of a domestic petrochemical industry provides a price cushion on the downside for the natural gas E&P industry, benefiting companies like Chesapeake and Painted Pony Energy.

- In January 2013, Chesapeake Energy signed a 10-year contract to supply 98.6 MMcf/d of natural gas to Methanex’s methanol plant in Geismar, Louisiana. The contract price reportedly uses a commodity other than natural gas as a benchmark (see here).

- On November 08, 2017, Methanex and Painted Pony Energy Ltd. announced the execution of a 14-year agreement to supply the majority of the natural gas required for the former company’s existing 600,000 ton/y methanol plant in Medicine Hat, Alberta. This agreement will commence in 2018 and features a competitive fixed price for natural gas. Contracted quantities will be lower in earlier years to allow for Methanex’s pre-existing natural gas forward purchase contracts, and will increase to roughly 48.8 MMcf/d or about 80-90% of the plant’s natural gas requirements from 2023 (see here).

Furthermore, the budding LNG export will supply additional support from the downside. All of these means that, in the long term, investors may not need to be as bearish about the natural gas producers as some have suggested (see here).

Note:

1. On May 2, 2014, Methanex reached an agreement with Total in relation to the latter’s natural gas delivery obligations pursuant to a long-term natural gas supply agreement between the two companies; Methanex received a lump sum payment of US$42 million from Total to terminate the agreement and settle all potential legal disputes thereunder (see here), finally being able to recoup part of the financial losses as a result of contract breach by suppliers.

The natural resources sector is poised for massive upside. I’d like to help you take advantage of the profit potential built into this once-in-a-decade opportunity. I’m a natural resources expert with over 35 years of experience in the industry, and I can spot trends and inflection points at these companies — often before the market. My Marketplace service, The Natural Resources Hub, provides timely commentary and insights, along with my best investing ideas, to help you become a better-informed and more successful natural resources investor. Sign up for The Natural Resources Hub today.

Disclosure:I am/we are long GPRK.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.